Exploring Foot Locker’s Origins

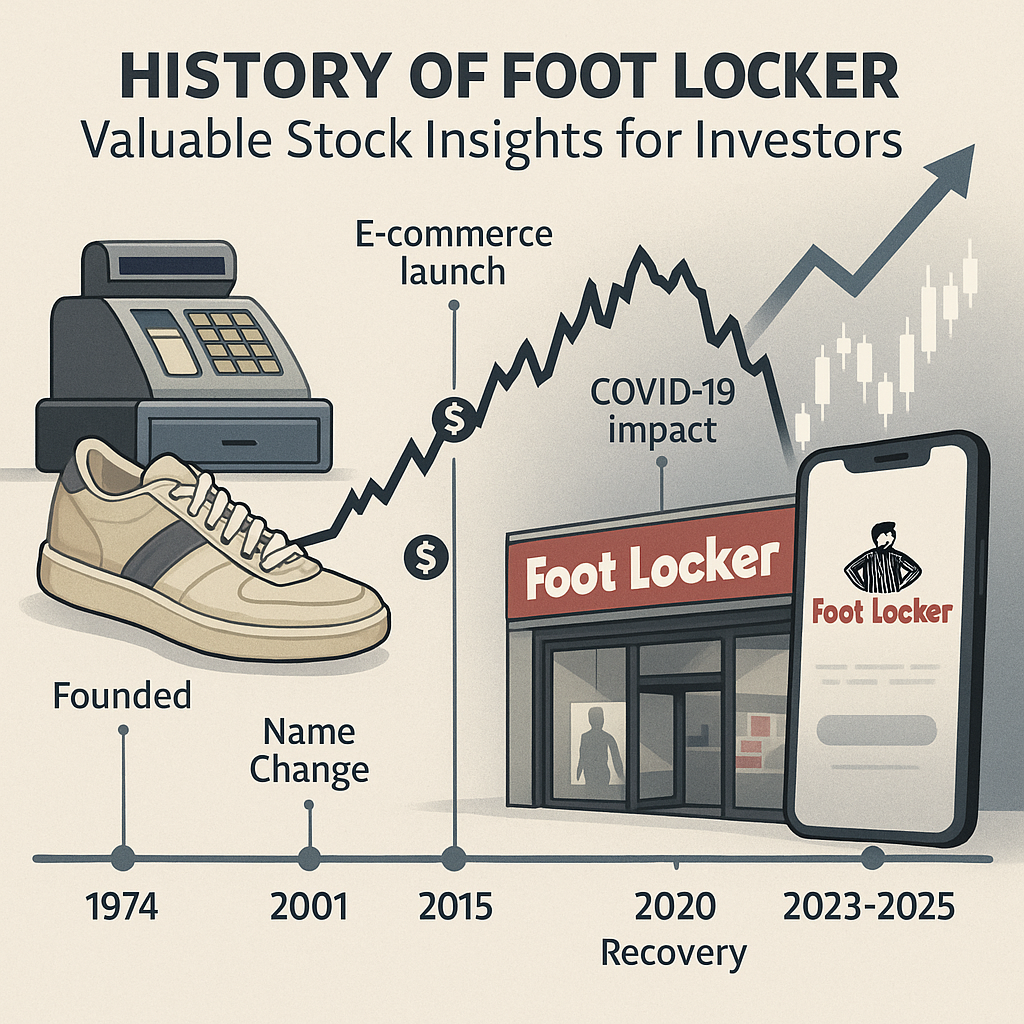

Foot Locker’s tale begins in the early 20th century when retail was evolving in America. Understanding these roots offers context for its later financial trajectory, shedding light on how a small shoe division became a top stock pick. Today’s trading community still references this history when evaluating FL’s stock narrative.

The Birth Of A Retail Powerhouse

In 1879, Woolworth established a discount store that was called a five-and-dime, changing forever the whole discount retail concept. With the passage of decades, its expansion across the U.S. laid the groundwork for another store banner, athletic shoe outlets.

Kinney Shoes And Early Beginnings

Kinney Shoe Corporation, founded in 1924, focused on affordable footwear. By licensing store space within Woolworth stores, Kinney grew rapidly. These early consolidations led to the creation of dedicated athletic footwear shops branded as Foot Locker in 1974.

Key Takeaway: Foundations Of Success

- Strong retail partnerships established credibility.

- Consistent demand for footwear created a loyal customer base.

- Early diversification strategies laid groundwork for future spin-offs.

Evolution Through The 20th Century

The mid-1900s marked both growth and turbulence. Foot Locker’s predecessors weathered wars, economic depressions, and shifts in consumer habits, influencing its corporate restructuring and stock valuations. These historical shifts still resonate with modern valuation models.

Growth During The 1920s To 1940s

During the Roaring Twenties, Kinney Shoes opened dozens of stores beyond department store concessions. Even during the Great Depression, cheap shoes remained in demand. Strategic acquisitions in the late 1930s bolstered scale just before World War II.

Postwar Challenges And Recovery

After WWII, manufacturing shortages and changing tastes forced retrenchment. Footwear demand dipped briefly but recovered by the 1950s as disposable incomes rose. Woolworth’s decision to acquire remaining Kinney shares in 1963 centralized operations under one umbrella.

Key Takeaway: Resilience In Retail

- Adapting to wartime constraints maintained brand visibility.

- Postwar consumer spending surge drove revenue growth.

- Vertical integration improved margin control.

Emergence As A Footwear Leader

As sneaker culture boomed, Foot Locker capitalized on youth trends. This section explores the brand’s transformation from a generic shoe outlet to a specialized athletic retailer influencing stock performance.

Launch Of The Foot Locker Banner

On the first of September 1974, the store was launched as a division of Woolworth. The uniforms, black and white striped, and basketball courts inside the store attracted the customers and for that reason differentiated the banner from other stores in the cluttered market.

Culture And Branding On Incarnate

During the fitness boom in the 1980s, Foot Locker blended perfectly with the athletic lifestyle. Celebrity endorsements and limited sneaker releases created a buzz that elevated foot traffic and same-store sales on positive earnings reports.

The Sneaker King Is Born

There were 2,500 stores all over the world by the early 1990s, with top-line growth coming from heavy advertising and major exclusive contracts with key brands, thus was born the stock as a growth vehicle for investors needing retail exposure.

Foot Locker’s Financial Milestones

Investors often gauge value by tracking key corporate events. Foot Locker’s IPO, stock splits, and dividend policies offer insights into management’s prioritization of shareholder value.

Initial Public Offering And Stock Debut

Foot Locker spun off from Woolworth in 1988, listing on the NYSE under ticker FL. Priced at $10 per share, the IPO raised capital to fund expansion. Shareholders from the parent company benefited from dividend distributions pre- and post-spinoff.

Stock Splits And Dividend History

Over the years, Foot Locker executed multiple stock splits (2-for-1 splits in 1992, 1995, and 1997). Dividends commenced in 1997, with a steady increase reflecting stable cash flows. See table below for detail.

| Date | Split Ratio | Dividend Initiation | Current Yield |

| June 1992 | 2-for-1 | – | – |

| May 1995 | 2-for-1 | – | – |

| June 1997 | 2-for-1 | Q3 1997 at $0.05 | 1.2% (2025) |

| August 2000 | – | Increased to $0.10 | 1.5% (2025) |

Key Financial Metrics For Investors

- Price-to-Earnings Ratio: ~15x (2025 estimate).

- Return on Equity: ~20%.

- Debt-to-Equity: 0.5x.

- Free Cash Flow: ~$300M annually.

Stock Performance And Market Analysis

Analyzing historical price movements and technical indicators helps traders identify entry and exit points. This section highlights patterns and metrics relevant to 2025.

Historical Price Trends

Foot Locker’s stock rose from its IPO price to a peak near $100 in early 2000s. After the 2008 financial crisis, shares hovered around $20 until a rebound in the mid-2010s. By 2025, FL trades near $45, reflecting a stable retail environment.

Technical Analysis Highlights

Common indicators include moving averages (50-day MA: $42; 200-day MA: $40), RSI levels (~55), and MACD crossovers signaling moderate bullish momentum. Volume spikes often coincide with quarterly earnings releases.

Key Takeaway: Timing The Market

- Watching support levels near $38 offers potential buying opportunities.

- Resistance around $50 may indicate profit-taking zones.

- Trendline breaks can signal shifts in retail sector sentiment.

Strategic Acquisitions And Diversification

To sustain growth, Foot Locker pursued acquisitions and online initiatives. These moves fortified its competitive position and impacted its valuation.

Digital Transformation And E-Commerce Expansion

By 2020, Foot Locker invested in its online platform, upgrading mobile apps and integrating AI-driven personalization. As e-commerce sales surpassed 40% of revenue by 2023, the stock benefited from wider margins and improved customer data analytics.

Partnerships And Acquisitions

Key deals include the 2015 acquisition of Eastbay, enhancing direct-to-consumer reach, and a 2022 minority stake in GOAT Group, expanding resale market presence. Such partnerships diversified revenue streams beyond brick-and-mortar.

Key Takeaway: Adapting To Consumer Trends

- Embracing omnichannel retail minimized dependency on mall traffic.

- Strategic investments in resale platforms tapped into secondary market profits.

- Data-driven marketing improved ROI on promotional spend.

Challenges And Opportunities In The 21st Century

Macro factors and industry trends shape Foot Locker’s future prospects. Investors must weigh risks against potential catalysts to make informed decisions.

Impact Of Economic Cycles And Global Crises

During COVID-19, store closures caused sales declines, yet e-commerce growth cushioned losses. Inflationary pressures in 2022-2023 squeezed margins, but prudent cost management preserved profitability.

Sustainability Initiatives And ESG Focus

Foot Locker launched sustainable materials sourcing in 2021, aiming for 30% recycled materials by 2025. ESG reporting transparency attracted institutional investors focused on responsible retail.

Key Takeaway: Future Growth Drivers

- International expansion in emerging markets represents untapped revenue.

- Continued innovation in eco-friendly products aligns with consumer values.

- Strategic pricing strategies can counteract inflationary headwinds.

Competitive Landscape And Market Position

Foot Locker operates in a crowded retail space. Understanding its rivals illuminates its unique strengths and potential weaknesses.

Principal Competitors And Benchmarking

Major competitors include Nike-owned stores, JD Sports, and Dick’s Sporting Goods. Benchmarking metrics show Foot Locker’s same-store sales growth (~3% in 2024) trailing some peers but outperforming general department stores.

Unique Value Proposition Of Foot Locker

Foot Locker’s curated sneaker selection and in-store experience set it apart. Exclusive drops and community events foster brand loyalty, driving repeat business and supporting stock stability.

Key Takeaway: Staying Ahead Of Competition

- Leveraging exclusive brand collaborations enhances foot traffic.

- Loyalty programs and experiential retail strengthen customer retention.

- Continuous market research ensures product offerings match trends.

Investor Takeaways And Recommendations

Investors should balance potential rewards with risks. This section outlines strategic considerations for building or adjusting positions in FL.

Key Strategic Insights For Investors

- Monitor quarterly same-store sales reports to gauge consumer demand.

- Track e-commerce growth metrics to assess digital progress.

- Evaluate margin trends to detect early signs of cost pressures.

Risk Factors And Considerations

- Shifts in sneaker trends may reduce demand for core offerings.

- Rising interest rates could increase borrowing costs, affecting expansion plans.

- Competitive discounting may compress profit margins further.

Long-Term Outlook And Forecast

Analysts project modest annual revenue growth (~4-5%) through 2027, with earnings per share rising due to operational efficiencies. Target price consensus sits near $55 by year-end 2025. For detailed financial models, refer to Foot Locker SEC filings.